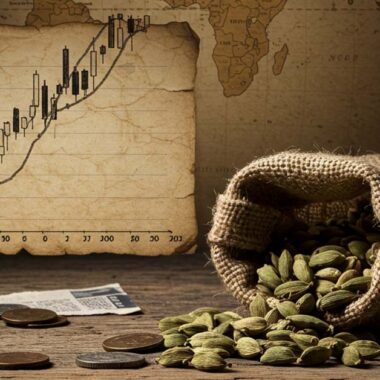

As one of the most expensive spices in the world, cardamom has long been prized for its aromatic flavor, health benefits, and culinary versatility. 🌱 It’s used in a variety of cuisines, from Indian to Middle Eastern to Scandinavian dishes, and its demand in global markets continues to grow. This raises an intriguing question for investors: Is cardamom a good investment? 🤔 In this blog, we’ll take a deep dive into the factors that make cardamom an attractive, yet risky, investment opportunity. 📉💵

🌍 Global Demand and Market Trends 📊

The global cardamom market has been steadily growing, driven by increased demand in both culinary and medicinal applications. As consumers become more health-conscious and seek natural remedies, cardamom’s appeal has risen—especially in markets like India, the Middle East, and Europe. 🌿🌍

- Culinary Demand: Cardamom is a staple in traditional cuisines like Indian, Middle Eastern, and Scandinavian cooking. As food culture becomes more globalized, the spice is being used in an increasing variety of dishes, from savory to sweet and even beverages like cardamom tea and coffee. ☕🍰

- Health Benefits: As people turn to more natural remedies, cardamom is becoming a sought-after ingredient in health products due to its digestive, anti-inflammatory, and antioxidant properties. This surge in popularity adds to its market potential. 💪✨

🌱 Factors Affecting Cardamom Investment 📉

1. Price Volatility 📈📉

One of the most notable features of cardamom is its price volatility. Due to factors like weather conditions, crop diseases, and market demand, cardamom prices can fluctuate dramatically. For instance, a drought or cyclone in key producing regions can result in a poor harvest, pushing prices up. Conversely, an oversupply can cause prices to drop.

- Supply Disruptions: Natural disasters, pests, and diseases can severely affect cardamom yields, creating short-term spikes in prices. While this can provide opportunities for short-term gains, the risk of crop failure is always present. 🌪️🚜

- Market Demand: The price of cardamom is also influenced by its demand in export markets. For example, if demand increases in countries like Saudi Arabia or Sweden, prices can rise due to scarcity. However, economic downturns can have the opposite effect. 📉📦

2. Initial Investment and Maintenance Costs 💵

Investing in cardamom farming or production requires significant initial capital. For those looking to invest directly in cardamom farming, here are some costs to consider:

- Land Acquisition: Cardamom is typically grown in tropical and subtropical regions, meaning you’ll need to secure land in areas with favorable climates like Kerala or Guatemala. 📍🌿

- Labor and Farming Inputs: Cardamom cultivation demands skilled labor and specialized farming inputs. Costs for fertilizers, irrigation systems, pest control, and other farming necessities can be high, especially for organic farming. 🌾💡

- Long Maturation Time: Unlike fast-growing crops, cardamom requires a longer maturation period (3-4 years) before it starts producing significant yields. This makes it a long-term investment with delayed returns. ⏳

3. Environmental Factors and Sustainability 🌎

Cardamom farming is heavily dependent on the environment. Climate change and unpredictable weather patterns can significantly affect production levels. As global warming continues to impact agricultural systems, it’s important to understand the sustainability risks tied to cardamom farming.

- Climate Vulnerability: Cardamom thrives in humid, tropical environments and is highly sensitive to extreme weather conditions. Droughts, floods, and rising temperatures can adversely impact the crop. 🌦️

- Sustainable Farming Practices: Sustainable and organic farming methods are increasingly in demand, but they require more effort and cost. However, they offer better long-term viability and higher prices, especially in international markets where consumers are willing to pay a premium for eco-friendly products. 🌱💚

🏞️ Cardamom Investment Options 🏠

1. Direct Investment in Cardamom Farming 🌱

For investors interested in a hands-on approach, buying land and growing cardamom could be a lucrative long-term investment. However, this requires significant expertise and resources, as cardamom farming can be labor-intensive and requires continuous maintenance.

- Pros: Long-term profits, potential for high yields, ability to control farming practices, high returns in years of good harvests. 🏡🌿

- Cons: High initial investment, exposure to climate risks, slow returns, market fluctuations. ⚠️💸

2. Investing in Cardamom-Focused Businesses 💼

Another option is to invest in companies or cooperatives that focus on cardamom processing and exporting. Many businesses in countries like India and Guatemala specialize in the packaging, export, and distribution of cardamom. By investing in such businesses, you can benefit from the growing demand without having to manage the farming aspect.

- Pros: Lower entry cost, quicker returns, exposure to global market demand. 🌍📦

- Cons: Less control over the cultivation process, potential issues with market competition, and business risk factors. 📉💼

3. Cardamom as Part of a Diversified Portfolio 📊

For those looking for a less hands-on approach, investing in cardamom through mutual funds or commodity trading could be an option. Many agricultural commodity funds include cardamom as part of a diversified investment strategy.

- Pros: Lower risk due to diversification, passive income, exposure to the agricultural market. 📈📊

- Cons: Lower potential returns compared to direct farming, dependent on the performance of the fund, market risks. ⚖️💼

💡 Is Cardamom a Good Investment?

While cardamom has potential for high returns, it is not without its risks. The volatility of prices, environmental challenges, and the long-term nature of the investment mean that those who wish to invest in cardamom must be prepared for patience and careful risk management.

- For Direct Farmers: Cardamom farming can be a profitable venture if managed properly, especially with sustainable farming methods that appeal to eco-conscious consumers. However, the investment is best suited for those with long-term goals and the ability to absorb the ups and downs of the agricultural market. 🌿💰

- For Investors in Cardamom Businesses: Investing in businesses that export, package, or distribute cardamom could be a more manageable option, offering quicker returns while benefiting from the growing demand for this valuable spice. 📦💼

Ultimately, cardamom can be a rewarding investment, but it requires careful planning, research, and an understanding of both the agricultural and market dynamics. 🌱🌍